If there are any words which capture the necessity and the reality that beckons for the Federal Mortgage Bank of Nigeria, those words are best represented by Repositioning and Performance.

They underly the rationale for setting up the bank many years ago, which is to provide service to Nigerians.

Undeniably, the quantity and the need of those Nigerians has not remained the same since the creation of the bank, decades ago.

This is why I am enthused by the theme of the management retreat which is: “STRATEGY REPOSITIONING FOR OPTIMIZED PERFORMANCE,” with sub themes of culture change and informal sector integration; and delighted to be the Keynote speaker.

Since the inception of the Muhammadu Buhari administration in 2015, the bank has a positive story of service delivery to tell in the number of mortgages issued, housing schemes funded and completed; changes in eligibility conditions to improve access to funding to mention a few.

But this positive story is only a small part of what is possible if the bank imagines and reinvent itself.

As the promoter of the bank, the Federal Government has infused the board and management with a sense of how it should be repositioned by constituting a more representative board that is reflective of our national diversity of gender, religion, ethnicity, and this has been achieved whilst increasing the number of banking professionals in the management and board.

The intention is to ensure optimum service to the real owners of the bank – The Nigerian public and contributors to the National Housing Fund (NHF).

This is a type of repositioning the government envisions and welcomes; one that emphasizes the banking identity of the institution.

After all, it is called a bank, it collects people’s money and gives out loans therefore it must be a bank and is expected to act like one.

Government has therefore supported the acquisition by the bank of core banking applications and software that reflects the reality of its environment today as distinct from many decades ago.

In addition, and consistent with our current thinking, the National Council on Housing and Lands has adopted the recommendation for the bank to seek NDIC’s insurance of its contributors’ funds just as is done for depositors in other banks.

These are some of the actions and events of strategy repositioning, intended to deliver optimized performance.

It is not my intention to steal the thunder of the board and the management as they will reveal to you the granular details of steps and processes being undertaken at various stages to invigorate the bank; including the sustenance of the initiative by previous board and management to embrace the informal sector.

Ladies and gentlemen, one of the obstacles to access to housing that we must remove is the one that impedes access to finance.

There are various factors that constitute this impediment but it is clear to us that the FMBN must not be one of those factors or the causative agent of those factors.

That would defeat the essence of the vision of the founders of the bank.

I know that the Bank is issuing mortgages, Home Refurbishment Loans and has started a Rent-to-Own initiative.

But is that all that the bank can do?

What can the bank do for contributors who need to pay 2 to 3 years rent in advance for monthly salary received in Arrears?

I must therefore commend board and management for the vision and the action behind the conception and the undertaking of this retreat.

It offers an opportunity for honest self-review and introspection, as it does for teambuilding and strategy planning.

My Keynote message as you deliberate on all options is to ask yourselves these questions: –

Have we fulfilled the vision of the founders?

How can we serve the owners better?

I urge all present to optimize the opportunities the retreat offers by participating maximally.

I wish you very fruitful and successful deliberations.

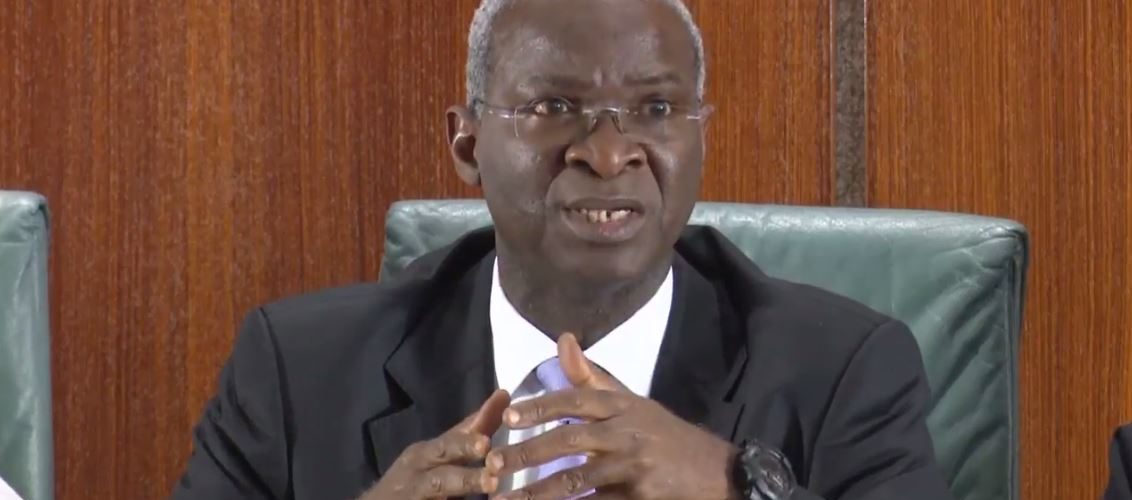

Babatunde Raji Fashola, SAN

Honourable Minister for Works and Housing

Monday 1st August 2022